Not that long ago, if you wanted a checking account, your only choice was one of a handful of local banks. Today, some of the best checking accounts can be found at banks that don’t even have a physical location.

Because of this, you can find a great checking option no matter where you live. However, not all checking accounts are created equal. This guide will help you compare companies like NBKC, Chime, and Current to determine which option is best for you.

Top 5 Best Checking Accounts in Pennsylvania: Compare Reviews and Ratings of Top Pa Companies

- PenFed Credit Union – Best Overall Checking Account in Pennsylvania

- Axos Bank for Nationwide – Top High Yield Checking Account in Pa

- PNC Bank – Best Financial Management Features in Pennsylvania

- Betterment – Best Checking Account for Pennsylvania ATM Users

- SoFi – Top Checking and Savings AccountCombination in Pa

- NBKC Everything – Top Pennsylvania Runner Up

- Chime – Top Pennsylvania Runner Up

- Current – Top Pennsylvania Runner Up

1. PenFed Credit Union – Best Overall Checking Account in Pennsylvania

PenFed Credit Union Checking Account Pros in Philadelphia, Pittsburgh, Allentown, and More:

- Earn interest on accounts under $20,000

- Overdraft protection

- Large, fee-free ATM network

PenFed Credit Union Checking Account Cons Pros in Philadelphia, Pittsburgh, Allentown, and More:

- High overdraft fee

- Out-of-network ATM fees not refunded

- Monthly fee

PenFed offers the features of a traditional bank with an interest-paying checking account and a large ATM network, making it our top pick among the best checking accounts.

Fees Associated with PenFed Checking Accounts in Pennsylvania: 4.4/5.0

PenFed charges a $10 monthly fee that it will waive if you maintain a balance of at least $500 or deposit at least $500 per month into your account.

There is a $1.50 charge for using an ATM outside of PenFed’s ATM network, and the company does not refund any of these charges.

There is also a $30 overdraft fee, though the bank does offer an overdraft line of credit to account holders who meet the credit requirements. The line of credit comes with a fixed rate APR of 17.99%.

If you do a lot of traveling, you should be aware of the 2% international transaction fee. You can find a complete list of PenFed’s fees on their website.

PenFed has the largest ATM network of our top picks, but if you are a heavy ATM user who spends a lot of time outside this network or an international traveler, this account may not be your best option.

Customers who routinely keep less than $500 in their checking accounts and do not want to sign up for direct deposit may want to look elsewhere.

Minimums Required by PenFed Credit Union in Pennsylvania: 4.8/5.0

PenFed is one of two of our top picks to require a minimum deposit to open an account, but at just $25, it should be easy for most people to meet.

The PenFed Credit Union ATM Network: 5.0/5.0

With 85,000 ATMs, PenFed has the largest ATM network of our top picks.

APY of PenFed Credit Union Pa Checking Accounts: 4.5/5.0

For balances under $20,000, PenFed pays an annual percentage yield of 0.15%, which, while significantly lower than a high-yield savings account, is much better than the national average for checking accounts of 0.03% APY.

Balances between $20,000 and $50,000 earn a 0.35% APY, which is 11 times higher than the national average. Balances over $50,000 do not earn interest.

PenFed Credit Union Pennsylvania Mobile Banking App and Online Tools: 4.8/5.0

PenFed’s mobile app does all the usual things, including allowing you to transfer money between your accounts and deposit checks from your phone. You can also use your digital wallet, compatible with Apple Pay, Samsung Pay and Google Pay, to make payments from your phone or smartwatch.

Apple users give the iOS app a 4.2 rating, while the Android version has a 4.5 rating on the Google Play store.

Overall Score of PenFed Credit Union Checking Accounts in Pennsylvania: 4.7/5.0

NBKC, Chime, and Current provide alternatives to PenFed.

2. Axos Bank for Nationwide – Top High-Yield Checking Account in Pa

Axos Bank for Nationwide Checking Account Pros Pros in Philadelphia, Pittsburgh, Allentown, and More:

- High APY

- No monthly fees

- Large ATM network

Axos Bank for Nationwide Checking Account Cons Pros in Philadelphia, Pittsburgh, Allentown, and More:

- Cash deposit fee at some retailers

- Higher than average opening deposit requirement

- Cash deposits limited to $500

Axos’ high APY is why we selected this as one of the best checking accounts for high-yield checking.

If you like the idea of earning high-yield savings accounts rates without having to maintain a separate checking and savings account, Axos could be a good choice for you.

Fees Associated with Axos Bank for Nationwide Checking Accounts in Pennsylvania: 4.5/5.0

With no maintenance or overdraft fees, Axos is a good choice if avoiding bank fees is a high priority for you. However, if you use ATMs a lot, be aware that Axos does not reimburse any out-of-network fees charged by other banks.

Minimums Required by Axos Bank for Nationwide in Pennsylvania: 4.7/5.0

Axos’ $50 minimum requirement to open an account is the highest among our top picks. However, there are no other minimum balance requirements.

The Axos Bank for Nationwide ATM Network: 4.8/5.0

Axos’ 80,000 ATM network is the second-largest among our top picks.

APY of Axos Bank for Nationwide Pa Checking Accounts: 4.9/5.0

Axos’ 0.90% APR on up to $150,000 is the second-highest among our top picks and rivals many high-yield online savings accounts. However, there are some strings attached. Account-holders can earn 0.45% APR for each of the two requirements to earn the full 0.90%:

- The first is that you must make direct deposits of $1,000 or more per month.

- The second is a requirement to make 10 or more Visa debit card transactions of at least $3 per month.

People who don’t use direct deposit or their debit card very much will not benefit from the high APY on this account.

Axos Bank for Nationwide Pennsylvania Mobile Banking App and Online Tools: 4.5/5.0

Axos’ mobile app allows you to manage all your accounts in one place and make mobile check deposits. Both Apple and Android users give the app a 4.8 rating.

Overall Score of Axos Bank for Nationwide Checking Accounts in Pennsylvania: 4.68/5.0

Axos not right for you? Check out NBKC Everything, Chime, and Current.

3. PNC Bank – Best Financial Management Tools in Pennsylvania

PNC Bank Checking Account Pros Pros in Philadelphia, Pittsburgh, Allentown, and More:

- No monthly fees

- No minimum to open online

- Robust money management tools

PNC Bank Checking Account Cons Pros in Philadelphia, Pittsburgh, Allentown, and More:

- High overdraft fee

- Small ATM network

- Low APY in some markets

PNC is our choice for best checking accounts for financial management because of its robust collection of money management tools.

If you want an account that will help you save money and avoid overdraft fees, PNC may be for you.

Fees Associated with PNC Bank Checking Accounts in Pennsylvania: 4.5/5.0

PNC’s virtual wallet checking account comes with no monthly fees, and the company will reimburse up to $20 per month of its $3 domestic and $5 foreign out-of-network ATM charges.

PNC’s $36 overdraft fee is the highest among our top picks, but the company offers several options to avoid it. You can find a complete list of PNC’s fees on their website.

Minimums Re uired by PNC Bank in Pennsylvania: 4.9/5.0

No minimum deposit is required if you open your account online.

The PNC Bank ATM Network: 4.2/5.0

With just 18,000 ATMs, PNC’s network is the smallest of our top picks.

APY of PNC Bank Pa Checking Accounts: 4.0/5.0

PNC’s virtual wallet accounts are available in a Spend version, which only includes checking, and a Spend, Reserve and Growth version that includes savings options.

The Reserve and Growth options pay an APY that varies by market. For example, in Arkansas, the Growth account pays a competitive 0.50% APY, but Reserve pays nothing.

By contrast, in New York City, Reserve pays a below market average rate of 0.01% APY and Growth pays 0.02% to 0.03% APY. You can check the rates in your area by putting in your ZIP code on the PNC site.

The PNC Bank Pennsylvania Mobile Banking App and Online Tools: 5.0/5.0

The online and mobile tools are where these accounts shine. If you choose the account with both checking and savings options, you can move money between your Reserve, Spend and Growth accounts.

Spend works like a regular checking account for your day-to-day spending. Reserve is a short-term savings option intended for saving money for upcoming expenses. Growth works like a savings account.

PNC’s money management tools feature calendars to help you track when your bills are due and alert you to days when you may be low on spending money. The Money Bar helps you budget your cash. You can set up alerts for due dates on your bills and get a warning when your account is in danger of being overdrawn.

You can choose to cancel payments if they will result in an account overdraft. If you opt to proceed, you have 24 hours to put money in your account to cover the expense before PNC assesses its overdraft fees.

The app, which has a 4.8 rating on the Apple App Store and 4.0 on the Google Play Store, also allows you to make mobile check deposits and use select digital payment methods, such as PNC Pay.

These features give you an incredible amount of control over your money and several different options to avoid overdrawing your account.

Overall Score of PNC Bank Checking Accounts in Pennsylvania: 4.52/5.0

PNC Bank isn’t right for you? NBKC Everything, Chime, and Current provide alternatives.

4. Betterment – Best Checking Account for Pennsylvania ATM Users

Betterment Checking Account Pros in Philadelphia, Pittsburgh, Allentown, and More:

- ATM fee reimbursements

- Mobile checking features

- Cashback rewards

Betterment Checking Account Cons in Philadelphia, Pittsburgh, Allentown, and More:

- Few ATMs take cash deposits

- Pays no interest

- No check deposits

Betterment is our pick for best checking accounts for frequent ATM users because it reimburses all ATM fees, including those from international banks.

Fees Associated with Betterment Checking Accounts in Pennsylvania: 5.0/5.0

Betterment charges no maintenance, ATM or overdraft fees, and it reimburses all ATM fees from both foreign and domestic banks.

If you travel often or want to use any ATM without worrying about being on the hook for an out-of-network fee, this account is a great choice.

Minimums Required by Betterment In Pennsylvania 5.0/5.0

There is no minimum balance requirement to open an account.

The Betterment ATM Network: 4.5/5.0

Betterment does not have its own ATM network, but because the company reimburses all ATM and foreign transaction fees, you can use any ATM that accepts Visa debit cards.

Additionally, Betterment offers cashback rewards of up to 5% when you use your debit card at stores such as Dunkin’, Walmart, Sam’s Club and Staples.

You also get free cell phone insurance if you use your debit card to pay your cell phone bill.

APY of Betterment Pa Checking Accounts: N/A

If earning interest on your checking balance is a priority, you need to look elsewhere. Betterment does not pay interest on its checking account.

Betterment Pennsylvania Mobile Banking App and Online Tools: 4.5/5.0

The mobile app is primarily an investment app that also allows you to manage your checking account.

Among its more unique features is the ability to lock your debit card or change its PIN in the app instead of having to call customer service. It has a 4.7 rating on the Apple App Store and 4.1 on the Google Play Store.

Overall Score of Betterment Checking Accounts in Pennsylvania: 4.5/5.0

NBKC Everything, Chime, and Current might be right for you if Betterment isn’t.

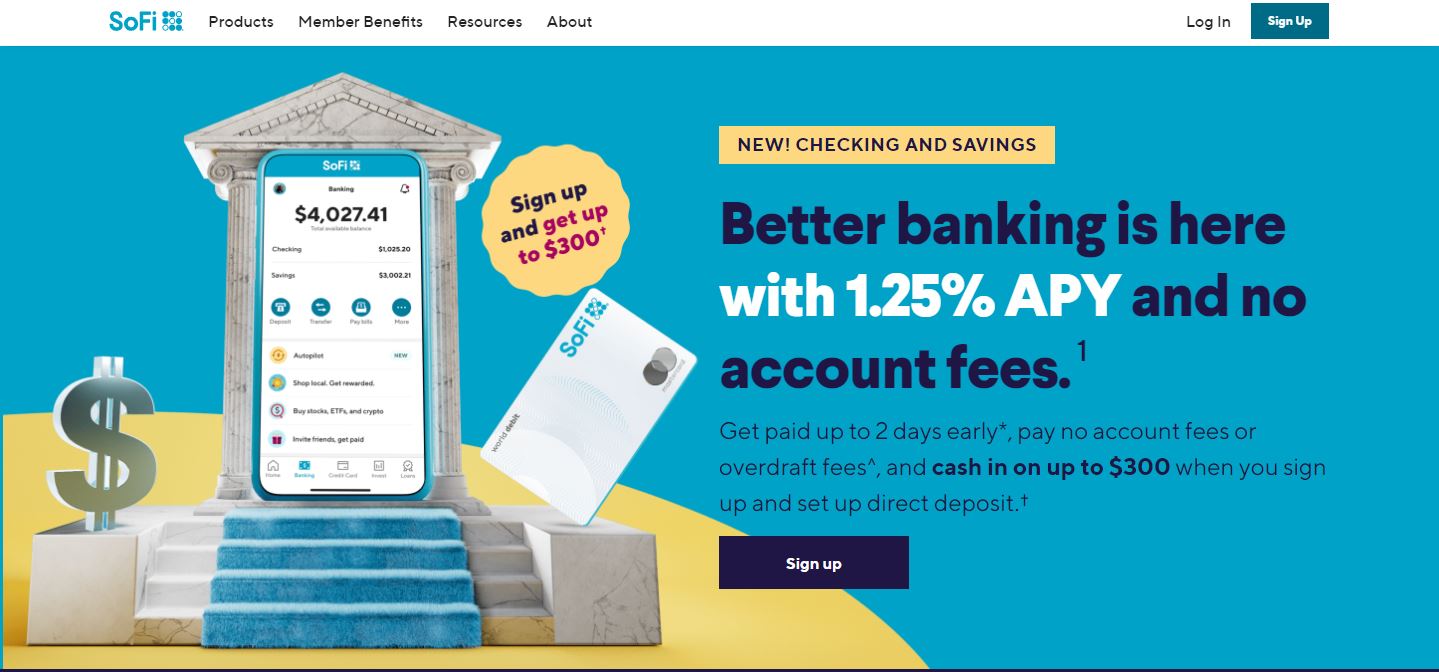

5. SoFi – Top Checking and Savings Combination in Pa

SoFi Checking Account Pros Pros in Philadelphia, Pittsburgh, Allentown, and More:

- No overdraft or maintenance fees

- No minimum direct deposit required for highest APY

- Cash deposits through Green Dot

SoFi Checking Account Cons Pros in Philadelphia, Pittsburgh, Allentown, and More:

- Does not reimburse third-party ATM fees

- Direct deposit requirement for highest APY

- Direct deposit requirement for overdraft protection

SoFi combines checking with a high-yield savings account that pays well above the national average, making it our top choice for best checking accounts that combine checking and savings.

Fees Associated with SoFi Checking Accounts in Pennsylvania: 4.4/5.0

SoFi does not charge maintenance or overdraft fees, and customers with a qualifying direct deposit are eligible for up to $50 in overdraft protection. SoFi does not reimburse any fees from out-of-network ATMs.

Minimums Required by SoFi in Pennsylvania: 5.0/5.0

There is no minimum balance requirement to open an account.

The SoFi ATM Network: 4.2/5.0

SoFi’s 55,000 ATMs make it the third largest of the ATM networks in our top five. You can earn up to 15% cashback when you use your debit card at some local establishments.

APY of SoFi Pa Checking Accounts: 4.5/5.0

SoFi offers a tiered APY that starts at 0.25% APY, which is less than a high-yield savings account, but eight times the national average for checking accounts.

If you sign up for direct deposit, you can earn a 1.00% APY on up to $50,000, which ranks among the top high-yield savings accounts. There is no minimum deposit required for this perk, but people who cannot use direct deposit have no way to earn the higher rate.

Balances over $50,000 earn 0.05% APY, so if you want to earn a better rate on large balances, you may want to consider other options, such as Axos, which pays its top rate on up to $150,000.

SoFi Pennsylvania Mobile Banking App and Online Tools: 4.4/5.0

In addition to the usual features, SoFi’s mobile app includes its Vaults and Roundups tools to help you increase your savings.

Vaults are where your savings go. You can have multiple vaults for different savings goals.

Roundups rounds all your debit card purchases up to the next whole dollar and moves the excess into your Vault account. Users give the iOS app a 4.8 rating and the Android version a 4.3.

Overall Score of SoFi Checking Accounts in Pennsylvania: 4.5/5.0

Still looking? Check out NBKC, Chime, and Current.

Top Pennsylvania Runners Up

These banks just missed our best checking accounts list.

How We Chose the Best Checking Accounts in Pennsylvania

We chose our top checking accounts based on how they compared with the features most important to customers at similar banks.

Our top picks offer customers easy access to their funds through ATMs, mobile apps, debit cards and digital payment methods.

Most of our top picks charge no fees or fewer fees than traditional checking accounts. These accounts have low or no minimum balance requirements and all but one of our top choices pays interest on checking balances that are substantially higher than the national average.

Additionally, several of our top accounts offer innovative tools, cashback options and other perks to account holders. Rates, fees and terms are accurate as of this writing but are subject to change.

What You Should Know About the Best Checking Accounts in Pa

How Are Checking and Savings Accounts Different in Pennsylvania?

Generally, checking accounts are intended for everyday spending. While some accounts do pay interest, the APYs are usually lower than on a savings account. The funds in checking accounts are usually easier and faster to access and do not have the same sort of transaction limitations that many savings accounts have.

Savings accounts are low-risk investments that pay a small amount of interest. Many people use savings accounts as an emergency fund or a place to save for upcoming expenses, such as a family vacation or the down payment on a home.

What Is Overdraft Protection?

Some banks offer overdraft protection that either pulls money from another account you own, such as a savings account, or provides access to a line of credit.

Overdraft protection uses your line of credit or funds from your linked account to cover transactions that would otherwise have caused you to overdraw your account. Some banks charge a fee or interest for this service.

Is There a Benefit To Having Multiple Checking Accounts in Pennsylvania?

If you have a joint checking account with someone else for shared expenses, it may be useful to also have individual accounts.

You may also want to have multiple accounts if your balance exceeds $250,000, because balances above that amount are not federally insured.

Some people choose to maintain separate checking accounts for online purchases as a way to limit the amount of funds available to someone who steals their debit card or account information.

How Much Money Should I Keep in My Pa Checking Account?

Keeping about two months worth of spending in your checking account provides you a cushion that can help you avoid overdrafts if you have an unexpected expense.

Why Not Just Keep All My Money in Checking?

Most checking accounts do not pay as much interest as a savings account, and some do not pay interest at all. If you have more money than you need for immediate expenses, it makes sense to put that money in an account that produces some type of return.

Because checking accounts are linked to debit cards and your payment information is probably stored in multiple databases, checking accounts are more vulnerable to theft than other types of accounts. If you keep all your money in one place and someone steals your account information or debit card, you could lose everything.

How Do I Choose the Best Checking Account in Pennsylvania for Me?

The main function of a checking account is to provide a safe place to keep the money you need for paying bills and day-to-day living. Most banks and credit unions are insured up to $250,000. However, some online banks are not traditional financial institutions and may not be insured, so it pays to check.

Consider how you spend your money. Do you pay all of your bills online or write checks? Do you do your banking at ATMs or a branch? Are digital payment options important to you or a feature you never use?

Choose an account that accommodates the ways you most often access your money. Another critical feature to consider is fees and minimum balance requirements.

If you usually keep less than $1,000 in your account, then it doesn’t make sense to open an account that charges you a maintenance fee if your balance dips below $2,000.

If you use ATMs a lot, you probably don’t want an account that charges ATM fees. While overdrawing your account is generally not a good idea wherever you bank, knowing you won’t have to dig out of a hole because of excessive overdraft fees can provide peace of mind.

After you’ve considered your needs, consider the perks. High APYs, cashback offers, online tools and other bonuses can help you get the most out of your checking account.

5 Best Checking Accounts in Pennsylvania Comparison

- Best feature: Large ATM network

- Fees: $10 monthly, waived with $500 balance or direct deposit; $1.50 per out-of-network ATM transaction; $30 overdraft; 2% international transaction

- ATMs: 85,000

- APY: 0.15% for balances under $20,000; 0.35% for balances between $20,000 and $50,000

- Best feature: High APY

- Fees: None

- ATMs: 80,000

- APY: 0.45% with a minimum of $1,000 per month direct deposit; 0.45% with a minimum of 10 debit card transactions over $3 per month; 0.90% total on up to $150,000

- Best feature: Financial management tools

- Fees: $3 domestic out-of-network ATM fees*; $5 international out-of-network ATM fees*; $36 overdraft fee; *reimbursable up to $20 per month

- ATMs: 18,000

- APY: Varies by market

- Best feature: Reimburses all ATM fees

- Fees: None

- ATMs: None*; *reimburses all fees to use other banks’ ATMs

- APY: None

- Best feature: Combines checking with high-yield savings

- Fees: None

- ATMs: 55,000

- APY: 0.25% without direct deposit; 1.00% with direct deposit on balances up to $50,000; 0.05% on balances over $50,000

Top Runners-Up

Our Final Thoughts on the Best Checking Accounts in Pennsylvania

Most checking accounts serve the basic function of providing you with a way to pay your bills and safely store your spending money.

The best checking accounts make it easy and inexpensive to access your money, pay above-average interest and come with perks and other features that help you get more out of your account than just a place to put your money.

Related articles:

- Best Trading Platforms in Pennsylvania

- Best Credit Repair Companies in Pennsylvania

- Best Pennsylvania Tax Prep Software

- Best Forex Brokers