If you can’t beat em’, guilt em’.

Some feel that’s the new mantra heading into 2019 for the collective that makes up the fundraising arm for the School District of Philadelphia, which sent out a letter over the holidays aimed at city residents who benefit from the 10-year tax abatement program.

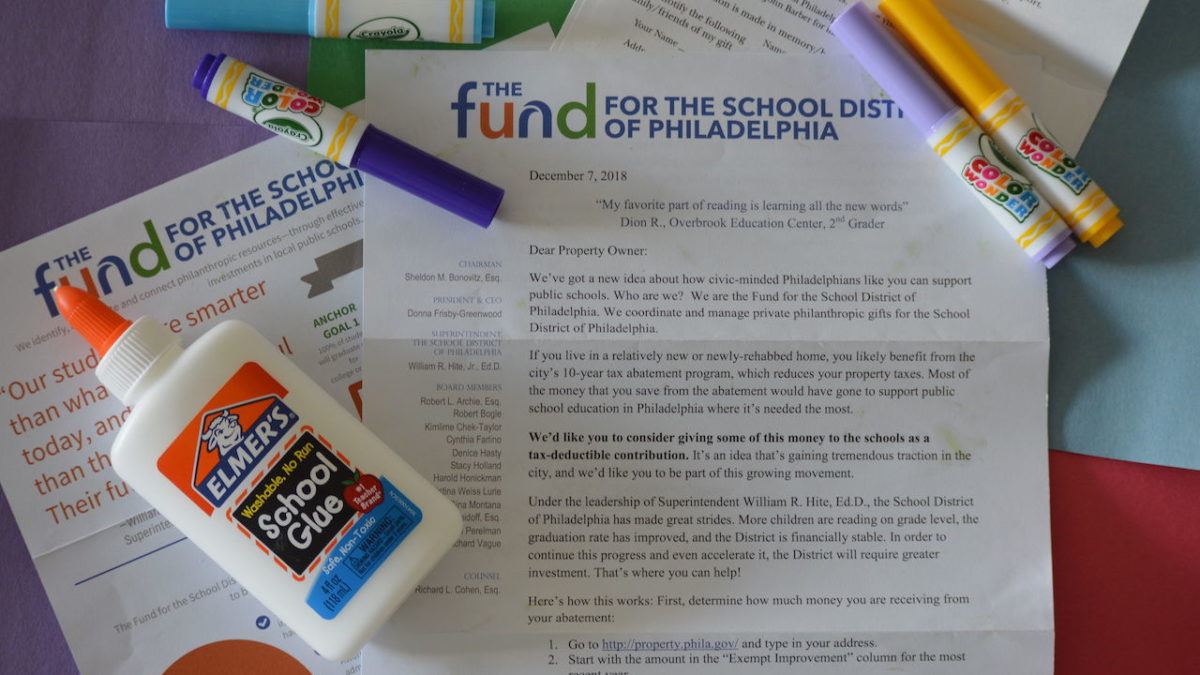

The letter, crafted by the The Fund for the School District of Philadelphia and signed by organization chairman Sheldon Bonovitz and Fund president and CEO Donna Frisby Greenwood, arrived in mailboxes of homes throughout the city just in time for the holiday giving season. It urges residents of either new or newly rehabbed homes to consider giving the rate they’re saving on paying taxes to the school district, piggybacking a controversial Dec. 4 report that claims the Philadelphia School District missed out on a whopping $62 million in direct taxpayer funding as a result of the abatement.

The Dec. 7 letter from the Fund even provides a formula for residents to figure out how much they’re saving in school taxes from the abatement. According to the letter, more than half of the approximate 1.3998 percent of the city’s property tax rate would have directly gone to fund schools to those that were exempt due to the abatement. The letter also states that about $48.3 million in revenue was lost from the 14,345 city properties that are listed with having an abatement.

The packet even offered an envelope to consider donating all or portions of the difference. A response for comment from the Fund went unreturned at the time of this report, but last month Greenwood told Philly.com, that this targeted list of residents with abatements – supplied by City Councilwoman Helen Gym, who has been outspoken in her efforts to end the program – is the perfect group to hit for a cash-strapped district.

“It’s an audience that makes sense for us, that certainly is invested in the city and should be asked,” Greenwood told Philly.com. “I talked to some other property owners and they said, ‘Well, no one’s ever asked me that,’ and I said, ‘Well, we’ll be asking.’”

However, some residents who received the letter found its efforts and timing to be shaming those who purchased abated property.

“I don’t know that I would’ve invested in this neighborhood without the abatement to be honest with you,” says Jeff DeCantrell, a UPS driver who purchased a new home in the city’s East Kensington section in 2010. I understand and sympathize with owners who have lived in this neighborhood longer and don’t have the adjustments I have, but this was and still is a section of the city that’s plagued by crime, drugs and needs the density to revitalize.”

Inez Ruiz, a mother of two also from East Kensington echoed DeCantrell’s sentiments and noted that without the abatement being able to purchase her two-bedroom, one-bath rehab just off Frankford Avenue wouldn’t have been possible.

“We may own a newer home, but we’re in the same boat; it’s not like I have all this money that I have saved because of the tax break,” Ruiz said. “I understand why they send it, they’re looking for money, I get that, I just thought the letter didn’t take into account that not everyone that can afford what these developers are charging for these homes these days have the means to go beyond, that’s why the abatement is so appealing. I’ll donate sure, but don’t suggest I do the math, figure it out and send you a check, I’m just not OK with that.”

TWITTER: @SPRTSWTR