I ran into an old colleague of mine recently who, like our publication is a part of an initiative called Broke in Philly.

It is a citywide collaboration of publications large and small raising awareness and ultimately solutions journalism to a variety of issues that keep Philadelphians in poverty. The collaboration is managed by Resolve Philadelphia, the upstart organization that sparked the success of the Reentry Project, last year.

If you don’t follow Resolve or the Broke initiative, I highly suggest it; it’s a wealth of good city-based journalists doing really noble work.

Back to my colleague. Under anonymity, he confided that there are problems even today that despite appearing to be on the level financially, are constantly holding him underwater. But he also noted savvy ways he’s staying afloat even though it inevitably comes to the detriment of his wallet — at times harder than he would like.

The first story he told was an ATM overdraft loophole. The second was the current struggles with his car and the work it needs to just to be street legal. Both stories may seem unique, but I’m willing to wager that there are many Philadelphians living just like him.

Just so you know he doesn’t define himself as living in poverty as his annual salary puts him out of that bracket, but it’s his responsibilities that find him consistently falling behind.

The ATM overdraft caper

“I make good money, but I’m living paycheck to paycheck. By the time I get my check, after bills, my mortgage, child support payments, car insurance, there’s less than $500 for the month — for me. Child support is the killer, but that’s for another day…My bank will allow me to overdraft $200 one-time and will charge me $35 to overdraft my account as long as my account is at a positive.

So there are times when I’ll go and I’m literally living on $200. The trick is making sure that everything in your account is pending because if I overdraft, not only will the bank charge me $35 for the $200 loan, but it’ll reject my scheduled payments for non-sufficient funds and then charge me $35 for each failed payment. They do it because they know that my salary is direct deposited and they will get their money. There have been times where I forgot about scheduled payments and I’ve ended up getting hit for like $500 between canceled payments and overdraft fees, so my paycheck is already going to be $500 less when it’s deposited because the bank makes sure to take its cut first.

It’s the most depressing thing to know you have to do and the shame of going to the ATM, especially when someone is standing behind you waiting for the machine, makes you feel so shitty about yourself — but I gotta eat and keep the lights on, so what do you do? It’s literally giving myself a payday loan with my own money.”

Trouble with the tranny

“I drive an older car, but it’s on the fritz. My inspection expired in June so I took it to my mechanic who said for it to be street legal, I’m going to need a new transmission. Well, a transmission for my car even a refurbished one is anywhere from $1800 to two-grand. I don’t have that to be putting in a 15-year-old car, so I drive it without my stickers.

Here’s the problem: park anywhere in the city and the PPA catches you without stickers its a $41 ticket. I’ve received four in the past two months, that’s $164. It’s literally cheaper for me to dump money to the PPA than it is to get my car fixed. And I have to drive into Center City all the time for story interviews, assignments, you name it. Every time I park it’s a dice roll if there’ll be a ticket or not.”

So then why not put it in a parking garage? I asked.

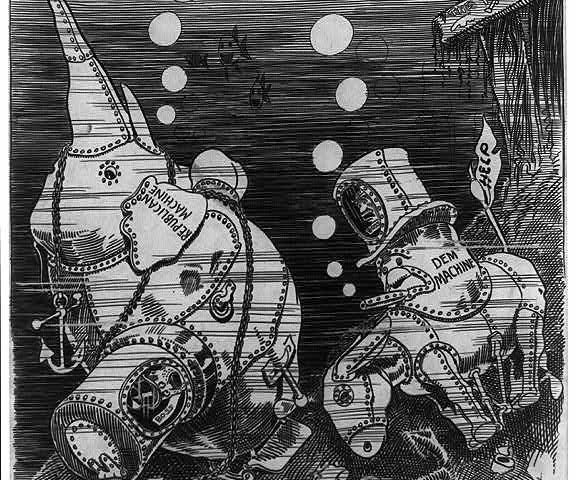

“Again, it’s rolling the dice of paying $3 to park for an hour versus a minimum of $12-15 at almost any garage in the city. Having to live this way has really showed me just how much there are processes in place to keep the poor, poor. I’m fortunate that I have a good job that I can pay my bills and maintain good credit but it’s only because I spent all of what I have to what I owe. I read a report that said 40 percent of working Americans spend half their income paying their debts. Well, I’m definitely a part of that 40 percent — which is criminal if you remember where we live.”

Any of these stories hit close to home? Do you use similar means just to stay afloat?

Email me at kgabriel@phillyweekly.com. Submissions will remain anonymous like my colleague’s here, but looking to compile stories like his for a larger piece. The goal to continue the conversation of what so many of us in Philly do just to keep from spinning out of control in the cycle of the struggle.

Philadelphia Weekly is a member organization of Broke in Philly, a collaborative reporting project among 23 news organizations, focused on Philadelphia’s push towards economic justice. Read more of our reporting at brokeinphilly.org.

Editor’s note: This is a reprint. This op-ed originally ran in Philadelphia Weekly on Nov. 2018. More from the Struggles series to come later this year.