I rarely get surprised anymore by the stories that come across my desk.

Sadly, a career in journalism can turn you into a cynic, real fast. Even if you try to remain an eternal optimist, the realization comes quickly that if something you report does incite change or offer a solution, there will likely be a loophole to allow whatever you reported on to continue. Thus, sad cycles often continue.

But this upcoming story we’re actively chasing and hope to have in the coming days is one that left me in disbelief, even after reading all of the documentation supporting its validity.

Last week, I, along with what I am sure were a number of other journos in the city, received an open letter from a woman claiming to suffer from an inoperable brain tumor. She says she’s destitute and relies heavily on funding she gets through disability from a local insurance carrier. However, in March, the insurance carrier canceled her disability claim, ultimately ceasing to pay her benefits.

This decision, while unfortunate, doesn’t even begin to scratch the surface of where this story starts to get fucked up. Naturally, the woman has appealed the insurance company’s claim — a time-consuming, highly stressful process for anyone, much less someone suffering from a brain tumor. To support its refusal, the insurance company hired a third party outfit tasked with finding evidence to support a denial of the claim.

In exchange for payment from the insurance company, this third-party company solicited the advice of a local doctor to review and validate the insurance company’s claim. The doctor’s findings are that the woman with an inoperable brain tumor can, in fact, return to work and doesn’t need the insurance company to assist in the support of medical treatments and medicines that can cost thousands of dollars.

This woman alleges that only past charts from physicians and a specialist she visited were used to make the ultimate determination, despite claims that her primary care doc concluded that her condition does qualify her for disability. Ultimately, the insurance doctor’s final decision came largely on his interpretation of findings from another specialist who did see this woman but was a specialist supplied by, you guessed it, the insurance company.

There’s more allegations that I’ll just save for the upcoming story, which will provide names of the Philadelphia-based insurance company and the Philadelphia-based physician employed by the Philadelphia-based university.

I’ve taken a lot into consideration in this case and am well aware that there are conflicting interests on both sides. The woman could be exaggerating her condition or in cahoots with her primary care doc to extend her disability for as long as possible.

I’d like to believe, however, that someone sending letters to anyone that would help is someone that is desperate for anyone to listen. What’s shocking here is that, if true, the level to which a company would go to avoid processing a claim by a woman with an inoperable brain tumor is not only appalling but lends insight into what we’re dealing with when we think we’re “covered” by these companies.

These same companies will cut you off for late payment of coverage but will find any and all loopholes to avoid paying you, including paying someone else to say that you no longer require coverage that you’ve bought into. What really struck me was this part of the open letter (parts have been redacted to preserve coming information on our site) wherein she writes the following:

“My purpose in writing this letter is to ask…whether it is appropriate for Department of Medicine faculty to consult on behalf of the insurance industry — an industry that has proven time and time again its priority is profit, not patients? If you were in my shoes — broke, disabled, and living with an inoperable brain tumor — would you trust the doctors of the world not to cash in on your tragedy?”

It’s a question I never really had to think about and one that this letter has seared into my mind since it reached our offices. Healthy people rarely have to think about insurance, which should ideally be there if you need it.

A safety net in an unsure world, right?

But it’s a scary thought that in the event you ever do need it, you have to constantly prove your value for coverage, knowing that there are those working in the shadows to deny you coverage if an insurance company deems you too high of a risk or that your threshold has maxed out the window for your condition.

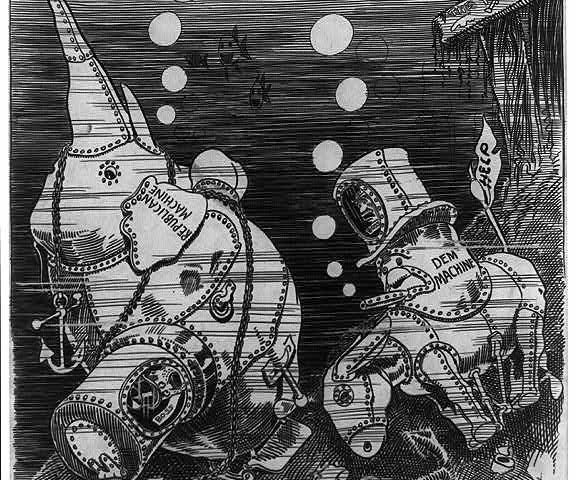

It’s always refreshing to get a timely reminder — in this case, at someone’s horrifying expense — that discrimination isn’t just a people-to-people occurrence. It has also gone corporate.

TWITTER: @SPRTSWTR